2022-05-11

2022-05-11

On May 10, Bitcoin accelerated its downward trend, falling below $30,000 at one point, and the lowest dropped to $29,767, a new low since July 19, 2021. As of writing, the price has rebounded, and the current price is $31,486.43.

In addition to the market, the algorithmic stable currency UST has won the attention of the market. On May 10, UST was seriously de-anchored and once fell to 0.6090 USDT; according to the Coinbetter data, it is now reported at 0.7968 USDT, with a 24H decline of 12.2%. LUNA once fell to 13.717 USDT, and is now at 16.151 USDT, with a decrease of 48.93% in 24H.

Coinbetter Research Institute: UST death spiral is the fuse of the 510 market decline

The de-pegging of the algorithmic stable currency UST led the Luna Foundation LFG to sell a large amount of BTC to save the market. The most direct impact of this was a drop in the price of BTC, which further caused market users to panic and sell BTC. BTC fell, LUNA fell, LUNA fell, UST continued to fall, and UST entered a death spiral!

In fact, stablecoin thunderstorms have occurred more than once in the history of the blockchain. In October 2018, USDT thundered for the first time. According to media reports at the time, the circulating market value of USDT was greater than the actual asset reserve, and the OTC price once fell to 4.5-5.0. A large number of USDT were sold and exchanged for BTC, which caused the BTC price to rise rapidly. Although USDT eventually returned to normal, BTC still fell below the 6K entering 3K started a long bear market.

LFG out of deposit, UST trust at stake

Coinbetter news, LFG's bitcoin address transferred 28,205.5 bitcoins again at 09:20:26 on May 10, and the balance of the address was 0 as of the time of writing. According to Coinbetter, the LFG bitcoin address first transferred 42,530 bitcoins and then 28,205 bitcoins in early May 10. After UST fell below $1, LFG announced that it would issue bitcoin and TerraUSD loans worth about $1.5 billion to help strengthen the peg to TerraUSD.

There are even more rumors that Jump, Alameda and other companies have provided another 2 billion US dollars to save UST. Regardless of whether this rumor is true or not, the spread still has positive significance for UST. The biggest problem is that even if they can get UST back to $1 by some kind of miracle, trust in luna has completely collapsed.

Coinbetter's latest news on May 11, according to The Block, citing three sources, reported that, The ecological nonprofit Luna Foundation Guard (LFG) is seeking institutions to raise more than $1 billion to support UST, and the deal is in talks.

Coinbetter Research Institute believes that the internal reason of the UST death spiral is that LFG's injection of funds into Anchor cannot solve the situation of Anchor's making ends meet.

UST is an algorithmic stable currency. LUNA absorbs the volatility of UST through arbitrage, but the peg mechanism of UST through arbitrage is also flawed. If the market fluctuates violently and the network is blocked, the arbitrage will be delayed and risky. Unlike over-collateralized stablecoins, whose value depends on market consensus, UST also supports its value through the market value of luna and the LFG reserve currency.

Anchor is a lending protocol on the Terra network, which provides depositors with an annualized return of about 20%. The generous return once gave UST a place in the algorithmic stablecoin sector. After development in 2021, the market value reached 16 billion US dollars . There are two sources of Anchor's income, one is the interest income paid by the borrower, and the other is the over-collateralization of the borrower when borrowing. Anchor will use the collateral to reinvest to obtain income. After budgeting, If Anchor continues to maintain a 20% APY, the annual loss will probably be about 1.7 billion US dollars. Continued losses will be a red flag for UST thunderstorms.

Therefore, LFG is a strong support for UST to maintain a high annualized income to the present. If Anchor wants to go on, LFG needs to continue to exert its strength. In order to enhance confidence in the market and reduce its own risks, LFG recently added BTC to its reserves. It is to endorse UST with BTC.

The development of algorithmic stablecoins has a tortuous road, where is the future?

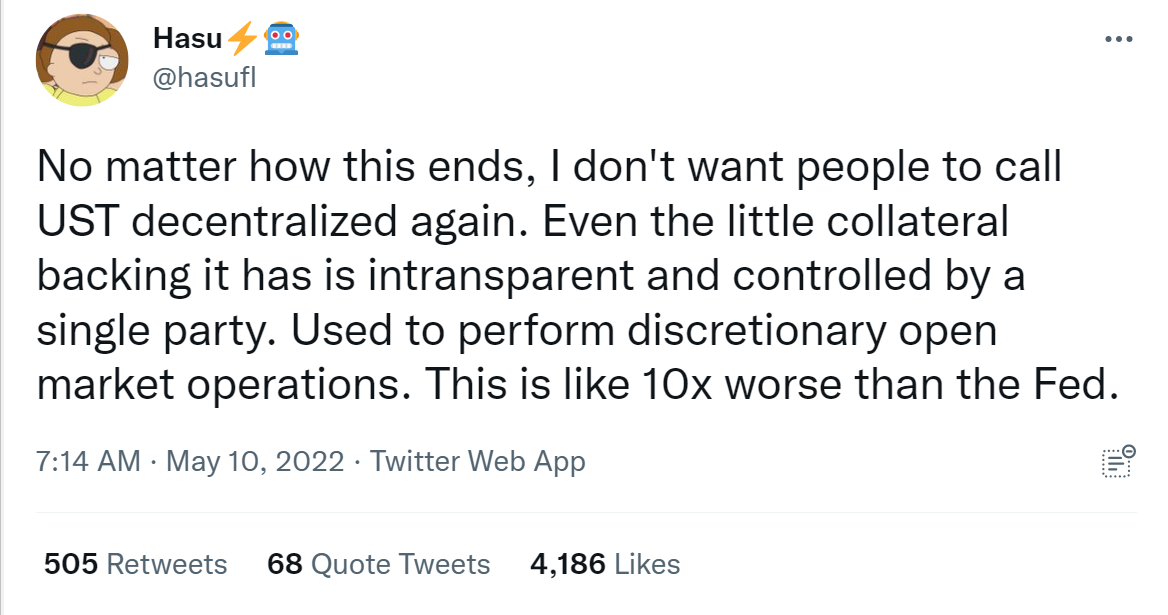

Paradigm research partner Hasu tweeted yesterday: “No matter how this ends, I don't want people to call UST decentralized again. Even the little collateral backing it has is intransparent and controlled by a single party. Used to perform discretionary open market operations. This is like 10x worse than the Fed.”

During a May 10 United States congressional hearing, U.S. Treasury Secretary Yellen pointed to the UST’s missteps and called for new stablecoin legislation to be passed by the end of 2022.

Some people say that UST is an innovative experiment in the history of the development of algorithmic stablecoins, while others believe that UST is actually a Ponzi scheme. The current UST plummet can be said to be a dark moment in the history of UST development. Whether to fall down or make a comeback to lead the algorithmic stablecoin market forward, we find the answer from the crisis and growth history of UST.